Cryptocurrencies

Individual coin ownership records are stored in a digital ledger, which is a computerized database using strong cryptography to secure transaction records, control the creation of additional coins, and verify the transfer of coin ownership. Despite their name, cryptocurrencies are not considered to be currencies in the traditional sense, and while varying treatments have been applied to them, including classification as commodities, securities, and currencies, cryptocurrencies are generally viewed as a distinct asset class in practice. Some crypto schemes use validators to maintain the cryptocurrency. In a proof-of-stake model, owners put up their tokens as collateral. In return, they get authority over the token in proportion to the amount they stake. Generally, these token stakers get additional ownership in the token over time via network fees, newly minted tokens, or other such reward mechanisms.

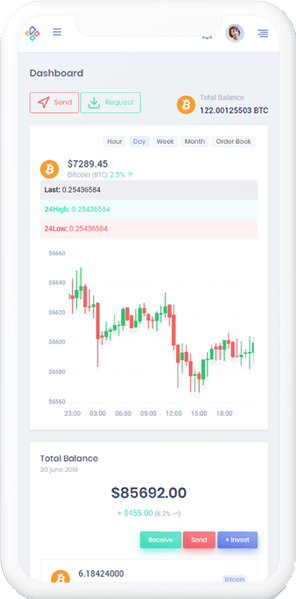

One of the most common forms of digital currency is the Bitcoin which was released in 2009. It's initial price was set at less than 1 cent as at 2010.

While it is still to experience its boom phase, it has quickly become a popular way of trading for many.

One of the big benefits of this form of trading is the money that there is to be made. The bitcoin, for example, hit a market cap of $160 billion by November, 2017.

There are considerably a few people trading cryptocurrencies which is an advantage because the market is yet to be saturated by others trying to get in on the game.

Deutsche bank has shown an increasing appreciation for the transformative potential of both blockchain technology—becoming one of the first to spearhead the development of its own Ethereum-based blockchain—and the cryptocurrencies based on it.

Just like Deutsche bank, Germany offers forex broker service, we also have cryptocurrency traders that specialize in the trading of this digital cash. Our job is to test them all out, put them through their paces and then present our information, for better result.

Invest to get Unlimited Access to Our Securities-Based Assets

Cryptocurrency does not exist in physical form (like paper money) and is typically not issued by a central authority. Cryptocurrencies typically use decentralized control as opposed to a central bank digital currency (CBDC). When a cryptocurrency is minted, or created prior to issuance, or issued by a single issuer, it is generally considered centralized. When implemented with decentralized control, each cryptocurrency works through distributed ledger technology, typically a blockchain, that serves as a public financial transaction database.

- The system does not require a central authority.

- The system keeps an overview of cryptocurrency units and their ownership.

- Ownership of cryptocurrency units can be proved exclusively cryptographically.

- The system allows transactions to be performed in which ownership of the cryptographic units is changed. A transaction statement can only be issued by an entity proving the current ownership of these units

Benefits of the program

Your loan will use your portfolio as collateral, without requiring you to sell your positions.

Blue Sand loans are typically lower than traditional banking products and have no origination or underwriting fees.

After completing the form, your loan may be approved in as little as 24 hours.

Less documentation is required compared with traditional lending products.

Getting Started in 3 Steps

Register an Account

Open an Account for free in just a few minutes and verify your email

Fund your Account

Easy and Secure, choose one of the multiple payment methods available, make deposits and get funded instantly.

Start A Plan

Choose any investment plan that suits your financial status and start earning instantly.